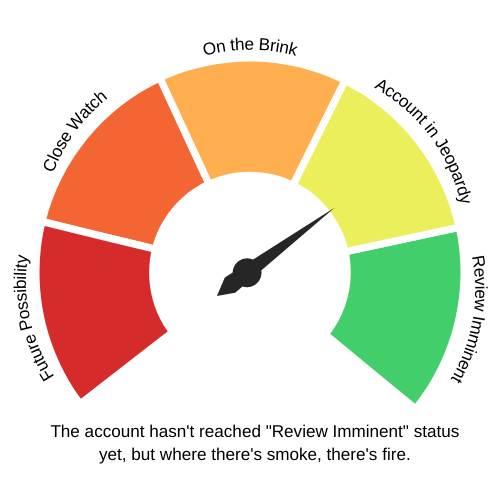

Male Opps: Bud Light taps new top marketer amid controversy (Score 81)

Sales Lead: Alissa Heinerscheid has taken a leave of absence from Bud Light (BL) after having overseen a disastrous partnership with trans activist Dylan Mulvaney.

- Heinerscheid joined parent company AB InBev in June 2022 with the goal of overhauling BL's marketing and freshening up its image.

- The recent partnership with transgender TikTok star Mulvaney led to a boycott and knocked $6b from the company's value, reportedly.

- Heinerscheid has reportedly been succeeded by Todd Allen, the global marketing VP for sibling brand Budweiser.

- The brand will likely:

- Pursue other influencer partnerships

- Return to higher spend to rebound from the slump in sales

- Seek new agency partners

- Target demographic:

- Men ranging from drinking-age (21+) Gen-Z through Gen-X

Additional spending insights:

- Broadcast insights (TV ad creative spend, effectiveness, impressions, and performance)

- YTD spend: BL has allocated roughly $1.2m toward national TV commercials YTD, a huge decrease from the roughly $17.9m allocated by this point last year.

- Last year: The brand allocated around $24.2m toward this channel in 2022 after having spent almost 4x this, around $88.1m, in 2021.

- 2023 ad programming: BL's 2023 commercials have targeted Gen-X watching shows such as House Hunters, Diners, Drive-Ins and Dives, Family Guy, WWE Monday Night RAW, and Diamond in the Rough.

- Digital and social insights (digital ad spend, effectiveness, impressions, and performance)

- YTD spend: So far this year, the brand has spent approximately $5.1m on digital ads, down 30% from the approximately $7.3m spent within the same 2022 timeframe.

- YTD data: YTD, BL has earned ~645.9m digital impressions via YouTube (43%), Facebook (22%), Twitter (17%), Instagram (15%), desktop display (2%), and mobile display (1%) ads.

- Last year: In 2022, the brand's estimated full-year spend of $21.7m was up 11% from that of $19.6m in 2021.

- Additional channel insights

- The BL brand utilizes linear, OTT, experiential, local broadcast, print, digital, radio, OOH, Google Ads, Facebook, Instagram, Twitter, and online video (via Youtube.com) ads.

- It holds planning conversations in Q1 and buying conversations in Q4.

- BL sponsors podcasts such as The Ben Shapiro Show, the Tim Pool Daily Show, X22 Report, Post Show Recaps, and Michigan Insider.

- Its sponsorship partners include teams such as the St. Louis Blues, Columbus Blue Jackets, Nashville Predators, Chicago Blackhawks, Dallas Stars, New Jersey Devils, Sporting Kansas City, The New Orleans Pelicans, Kansas City Chiefs, and Philadelphia Flyers.

Additional agency insights:

- Opportunity: Agency shifts could easily follow this appointment, so if you haven't yet done so, reach out to offer brand-specific PR, media, experiential, and/or multicultural services.

- Current agency roster:

- Anomaly: Creative AOR (Bud Light beer brand - August 2022)

- The Martin Agency: Creative AOR (BL's Seltzer and Next brands - August 2022)

- 160over90: Digital agency partner

- Dentsu: Agency partner

- View AB InBev's full roster here.

Insight Sources: Broadcast, linear, and OTT insights estimated by iSpot; digital spend insights estimated by Pathmatics; additional channel insights estimated by Vivvix; podcast insights by Podchaser; sponsorship insights by Relo Metrics.