BSSP Agency Profile

Company Overview:

BSSP is an agency with a focus on advertising. They are a privately held agency.

BSSP Clients

Explore a detailed list of current and past client that work with BSSP. Sort clients by location, industry, and agency assignment including creative, PR, media planning, media buying and more. With Winmo’s detailed database, you can quickly see which clients list BSSP as the Agency of Record as well as the annual media spend.

Does BSSP have a holding company?

Independent/Other is the holding company for BSSP.

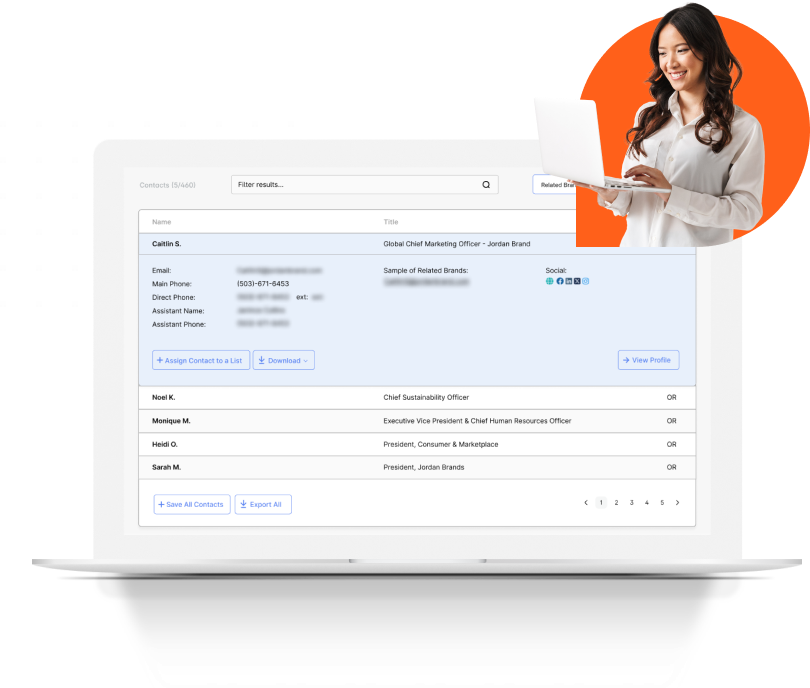

BSSP Employees

Explore a complete list of BSSP employees. We not only have the basics on each team member such as name, job title, brand responsibilities, email, and direct phone number, we also have detailed profiles that include unique insights, do’s and don’ts for engaging, plus both DiSC and Ocean personality profiles.

How many employees does BSSP have?

BSSP has an unknown number of people on their staff.

Email:

Address:

Win More with Winmo

If you are looking to tap into marketing spend managed by BSSP, Winmo paves a clear path to engaging the right contacts at the right time. Whether you are navigating large holding company agencies, or need to know account responsibilities of boutique shops, Winmo connects agencies, clients, and ad spend in an intuitive platform built for new business - even providing you with AI-powered email templates based on BSSP decision-makers' personality types. Winmo's award winning platform tracks this intel for those who control $100 billion in marketing spend each year, making it the top choice among sellers of agency services, advertising, marketing technology, or corporate sponsorships.

Request a demo to get full access to this profile.

Looking for a resource to grow your sales? Winmo helps you source more leads by connecting with the right prospects at the right time.